Vericast reimagines how you connect with your best customers. Our Deposit & Household Acquisition solution is built to help financial institutions quickly secure deposits needed to fund loans and win valuable customers.

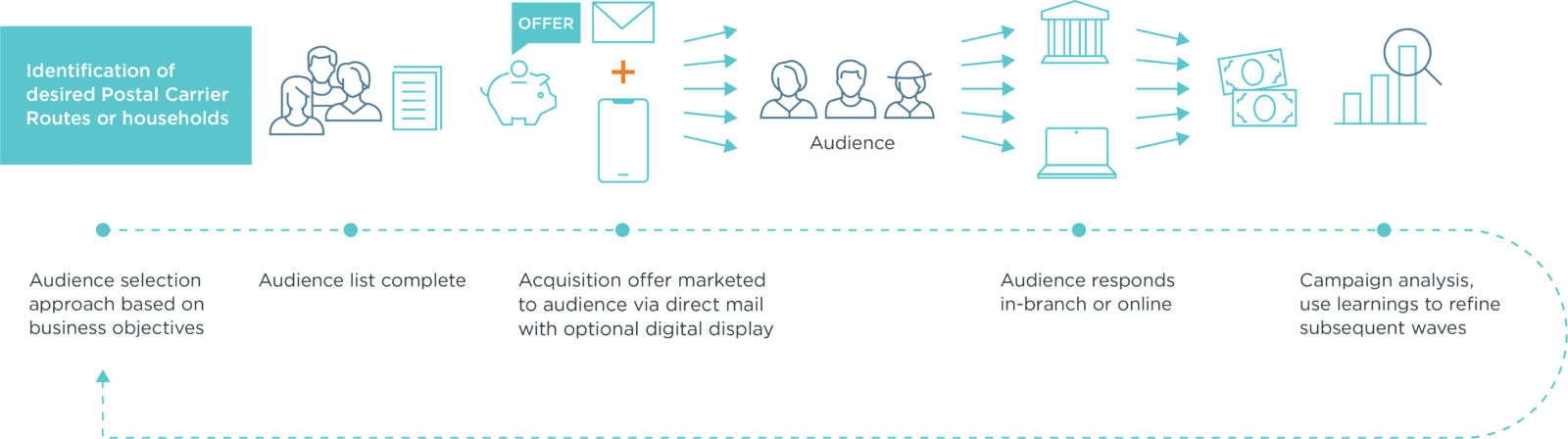

How it Works

We help financial institutions like yours drive a rising tide of new deposits and high-yield customers to stay competitive in today’s crowded market.

We use a strategy of personalized direct and digital marketing tactics to engage consumers in the spaces where they make decisions.

We customize your creative to speak to specific individuals across the audiences that mean the most to your financial institution.

You’ll receive exhaustive response analysis including demographics to help inform and refine every wave and make your communications more targeted and effective over time reaching:

- Look-a-like Consumers

- Small Business Owners

- Seniors, Millennials, etc.

- Existing Customers for Cross-sell; and

- New Movers

Turnkey Solutions Drive Continuous Results

Features & Benefits

- “In the Neighborhood” Isn’t Good Enough

We know deposit balances and product use varies widely by household even in a single neighborhood. Targeting new customers by where they live geographically — GEO targeting — doesn’t always identify the best prospects. Our solution targets individual prospects at economical postage rates to reach the households that mean the most to you.

- Unmatched Audience Selection Capability

Identifying your best deposit and household acquisition prospects requires understanding a wide variety of data layers from consumer to behavioral to purchase potential and more.

- Right Products – Right Incentives – Right Time

Offer the right product at the right time with the right incentive and you’re miles ahead of your competition in landing the accounts that matter most. Our approach enables you to be highly targeted, specifically personalized and significantly relevant to your audience. Every time.

Case Study

Multi-Wave Acquisition Campaign Delivers $86M Total Balances and 340% ROMI

A 19-branch bank in the Southeast sought to not only improve checking account acquisition, but also improve the value of each account.

You may also be interested in…